Financial Advisors

Modern Alternatives Platform for Fiduciaries

THE ALTERNATIVE FUTURE

For Fiduciaries, the current data supporting the value of the private market serves as a call to action for your firm and the value you provide your clients.

69.2%

of new capital raised in 2019 came from private markets.

1/2

The number of public companies has reduced by nearly half since 1996.

$3T

“Companies raised $3.0 trillion in private markets and $1.5 trillion in public markets in 2017.”

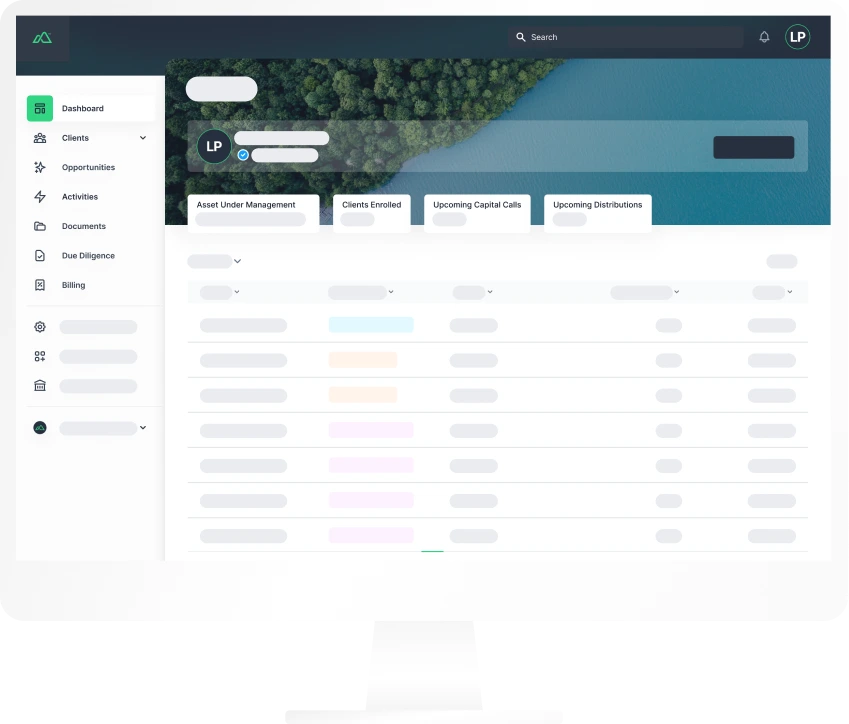

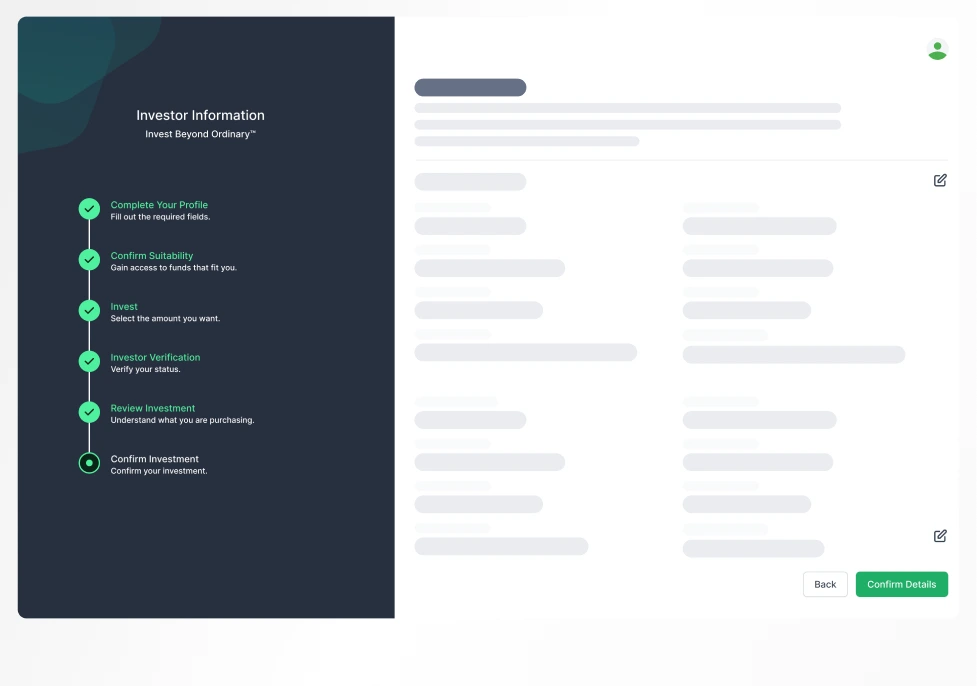

GETTING STARTED

Efficient Enrollment + Onboarding

Investing in alternative deals should be efficient, integrated and executed in conjunction with a financial advisor. It’s time to use a platform that delivers what you need.

Support for Accredited Investors and Qualified Purchasers

Efficient KYC/AML Checks

Compliant Identity Verification

IRA Support

Streamlined ACH Support

Lower Minimums on Funds Than Typical Alternative Investments

COMPLIANCE

Best Practice Compliance, Modern & Accountable Customer Service

There is no need to sacrifice on service. Mammoth provides you with dedicated professionals who know wealth management, SEC and FINRA regulations and can support your compliance needs.

Support for Client Agreements and Compensation Structures for Private Investments and Alternatives

Support on Form ADV for offering alternative investments

Compliance Manual Support to Properly Offer Private Investments and Alternatives

RIA FRIENDLY FUNDS

Highly Curated Funds Built for Advisors

The Funds on Mammoth’s Integrated Alternatives Platform️ are designed to maximize the advisor-client relationship.

Review

Invest

Manage

Keep your back office up to date through integration services and investor relations communications. You can use your platform to keep your clients and your team up to date.

Subscribe to Our Monthly Newsletter

Only valuable content, never spam. Opt-out whenever you want.