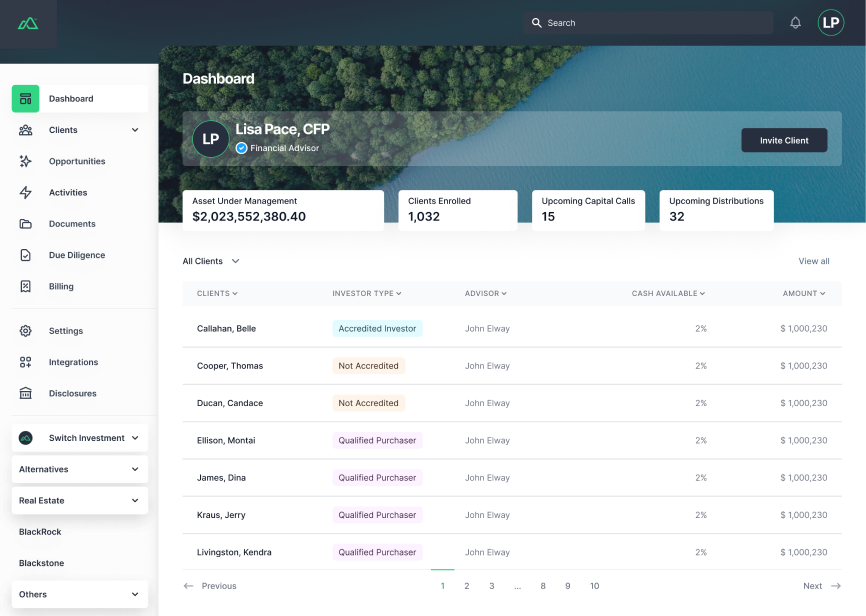

Create & Manage Alternatives with Speed and Scale

Bridge the gap between investors, financial advisors, and fund managers through an intuitive, integrated platform branded to you.

Comprehensive Solutions

Mammoth can support you from the inception of your first fund to the management of an extensive portfolio. We excel in streamlining every aspect of the process, from fund setup to investor relations support to comprehensive reporting.

Digital Data Room

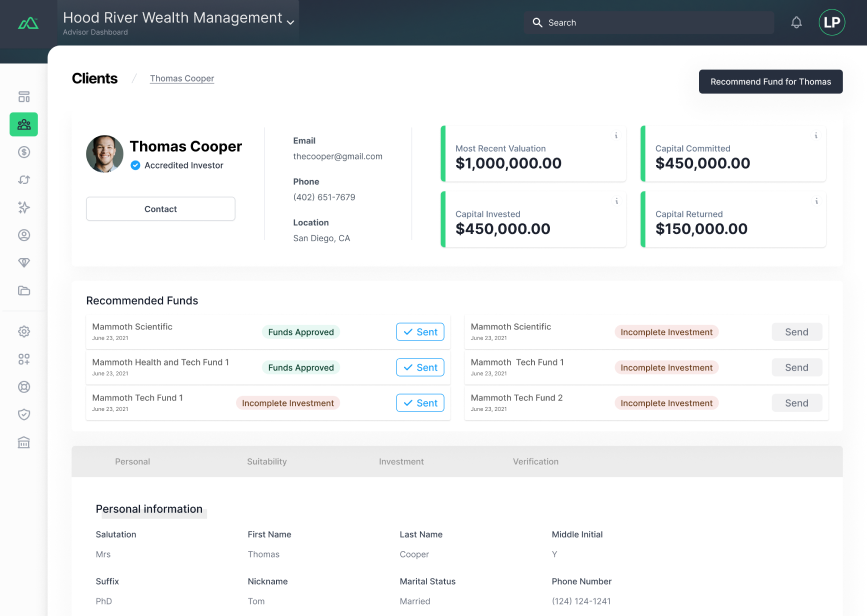

Send digital Data Room invitations directly to your potential investors.

Subscription Documents

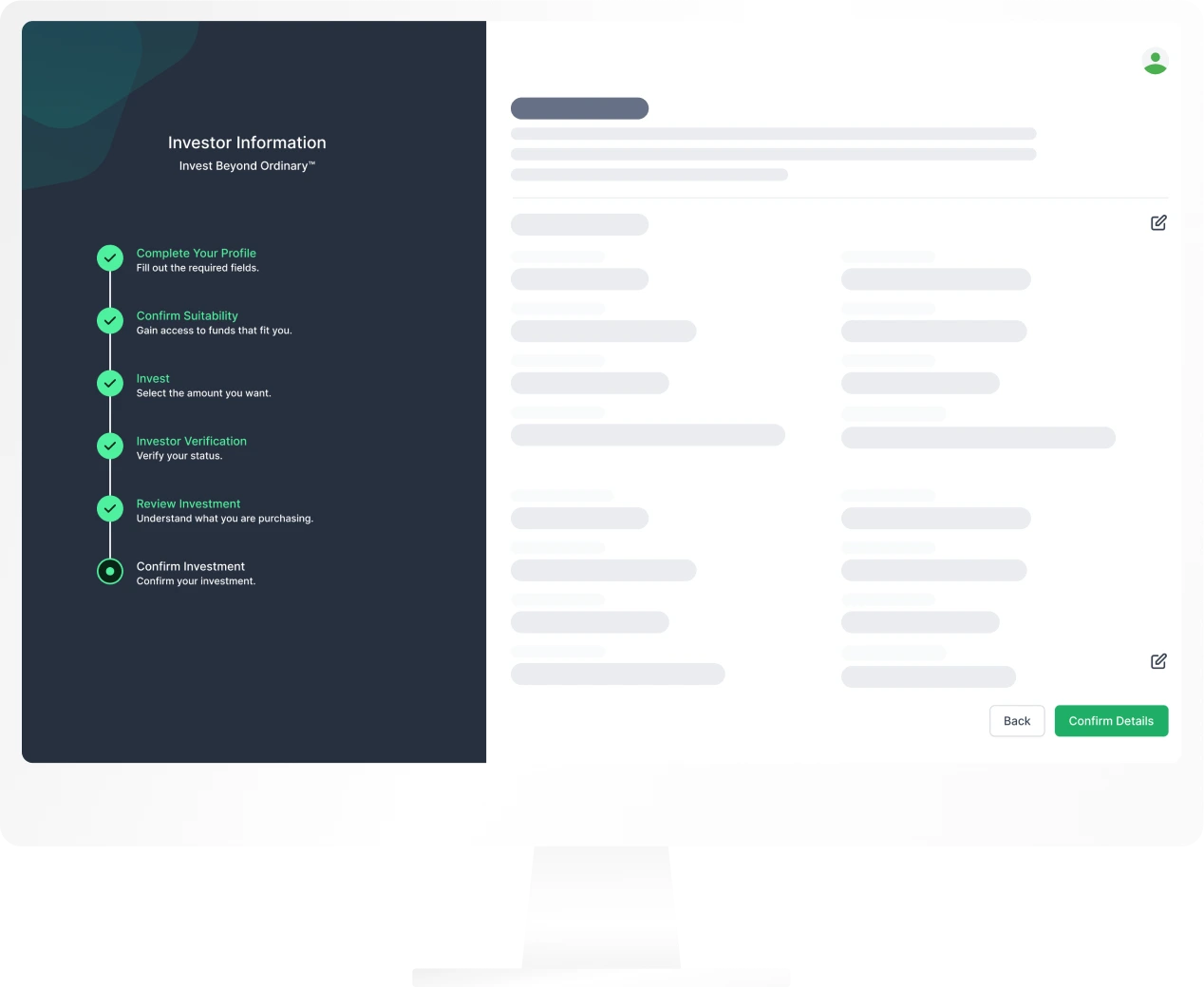

From a basic investor application to your full document stack, your investors move through a simple, customized workflow in minutes.

Verification

From KYC to AML and beyond. Map beneficial owners intelligently, efficiently screen against sanctions lists, and confidently accept investors into your fund.

Investor Updates

Provide tax documents, fund updates and distribution information compliantly.

Investors

Financial Advisors

Founders

Fund Managers

-

- Investor Relations Support

- Efficient KYC/AML Checks

- Compliant Identity Verification

- IRA Support

- Streamlined ACH Support

-

- Get your documents in order with less legal expense.

- Keep them in one convenient location.

-

- Statement Processing

- Billing Assistance

- Compliance Assistance

-

- Digital Data rooms

- Electronic subscription process

- Simplify your fundraising strategy to accelerate time to close.

Alternative Investments Scaled

Get expert integration guidance from our professional services team to gain value faster. We excel in streamlining every aspect of the process, from fund setup consultation to investor relations support to comprehensive reporting. Discover a better alternative investment experience.